A thriving bakery, filled with the delightful aroma of freshly baked goods, could face a devastating lawsuit after a customer claims they suffered food poisoning. Without the best business liability insurance, the owner could be forced to close their doors, losing everything they’ve built. This scenario underscores the essential role of business liability insurance in safeguarding your company’s reputation, finances, and ultimately, its survival. Securing the best liability insurance for small business owners is not just about minimizing costs it’s about ensuring your company’s long-term financial stability and success.

Understanding Business Liability Insurance

Business liability insurance is a fundamental safeguard for any small business owner, offering protection against financial losses stemming from third-party claims. This insurance is not just about protecting your company from lawsuits; it’s also about ensuring your business can continue to operate smoothly in the face of unexpected events. Whether it’s an injury, property damage, or other liabilities, having the right coverage can prevent unforeseen expenses from derailing your business.

Types of Business Liability Insurance

-

General Liability Insurance

This essential policy covers claims related to bodily injuries or property damage caused by your business. It helps cover medical expenses, legal fees, and settlement costs, making it a cornerstone of the best liability insurance for small businesses. For example, if a customer trips and falls in your store, a general liability policy could cover medical expenses, legal fees, and potential settlements, preventing a costly disruption to your business operations.

-

Product Liability Insurance

If your business manufactures or sells products, this insurance protects against claims of harm or damage resulting from those products. It’s essential for businesses involved in retail, manufacturing, or distribution. Product liability insurance not only protects your business but also reassures customers that they are safe when using your products.

-

Professional Liability Insurance (Errors and Omissions)

Also known as E&O insurance, this type protects service providers against claims of negligence related to their professional services or advice. If you offer consulting or professional services, this insurance is crucial. It helps cover legal fees and settlements if a client claims that your advice caused them financial harm.

-

Employment Practices Liability Insurance

This policy covers lawsuits from employees alleging wrongful termination, discrimination, or harassment. With the rise of workplace-related claims, having this coverage is essential for protecting your business and employees. The #MeToo movement and increased awareness of workplace harassment have led to a surge in employment-related lawsuits. In 2023, there was a 15% increase in employment practices liability claims compared to the previous year. Businesses are becoming more proactive in implementing policies and training programs to prevent harassment and discrimination, and they are also seeking employment practices liability insurance to protect themselves from potential legal action.

-

Commercial Auto Insurance

If your business uses vehicles for operations, commercial auto insurance is necessary. It provides coverage for accidents involving business vehicles, protecting your assets on the road. This insurance is crucial for businesses that rely on transportation to deliver goods or services.

-

Workers’ Compensation Insurance

This insurance is mandatory in most states and covers medical expenses and lost wages for employees injured on the job. It ensures your employees are protected while also safeguarding your business from potential lawsuits. By providing this coverage, you show your commitment to your employees’ well-being.

-

Cyber Liability Insurance

In today’s digital age, cyber liability insurance is becoming increasingly important. The rise of ransomware attacks and data breaches has made this coverage essential for businesses of all sizes. The average cost of a data breach in 2023 was $4.24 million, highlighting the significant financial risks associated with cyberattacks. Businesses are now prioritizing cybersecurity measures and investing in cyber liability insurance to mitigate the financial and reputational damage of data breaches.

Customizing your business liability insurance based on your specific needs and risks is vital. By understanding the different types of coverage available, you can ensure you’re adequately protected.

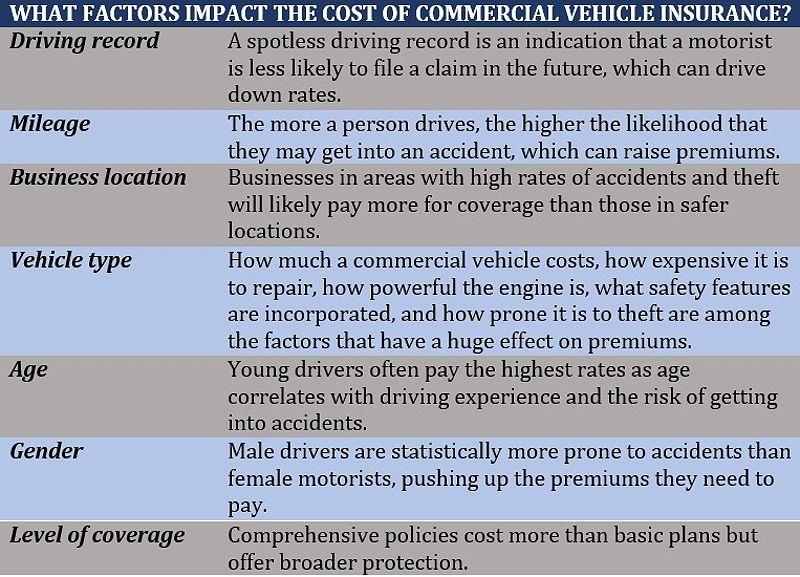

Factors Affecting Business Liability Insurance Costs

The cost of securing the best business liability insurance can vary significantly based on several key factors:

Industry

Businesses in high-risk sectors, such as construction or healthcare, typically face higher premiums due to the increased likelihood of claims. For instance, a construction company may encounter more accidents than a consulting firm, leading to higher insurance costs.

Location

Your business’s geographical location can influence insurance costs. Areas prone to natural disasters or with higher crime rates may result in higher premiums. If your business is located in a region with a high incidence of theft or vandalism, you may pay more for coverage.

Business Size

Larger businesses with more employees generally incur higher liability insurance costs due to increased exposure to claims. More employees mean more potential for workplace injuries or claims, which can drive up premiums.

Claims History

If your business has a history of lawsuits or insurance claims, insurers may view you as a higher risk, resulting in elevated premiums. A clean claims history can help you secure better rates, while a poor history may necessitate more extensive coverage.

Coverage Limits

Higher coverage limits equate to higher premiums, but they also provide greater financial protection in case of a significant claim. Assessing your business’s specific needs can help you determine the appropriate coverage limits.

Deductibles

Choosing a lower deductible means you’ll pay less out-of-pocket in the event of a claim, but it will typically result in higher premiums. Balancing your deductible with your budget is an essential part of selecting the right coverage.

State Regulations

Each state has its own regulations that can impact the cost of business liability insurance. Understanding these regulations can help you budget effectively and ensure compliance, which may also affect your premiums.

By considering these factors, you can better understand how to compare liability insurance for small businesses and find a balance between comprehensive coverage and affordability.

Finding the Best Business Liability Insurance for Your Needs

When searching for the best business liability insurance, there are several steps you can take to ensure you secure the right coverage at a competitive price:

Assess Your Risks

Start by evaluating the potential liabilities specific to your industry and business operations. This assessment will help you determine the types and levels of coverage you require. For example, a restaurant may face different risks than an IT consulting firm, necessitating tailored coverage.

Compare Quotes from Multiple Providers

Utilize online comparison tools or collaborate with an independent insurance agent to gather quotes from various reputable providers. This approach allows you to find the best combination of coverage and cost. Comparing quotes can help you identify which providers offer the best value for your specific needs.

Consider Your Budget

Establish a realistic budget for your business liability insurance premiums while ensuring you maintain adequate protection. Be mindful of your cash flow and long-term financial goals when determining how much you can afford to spend.

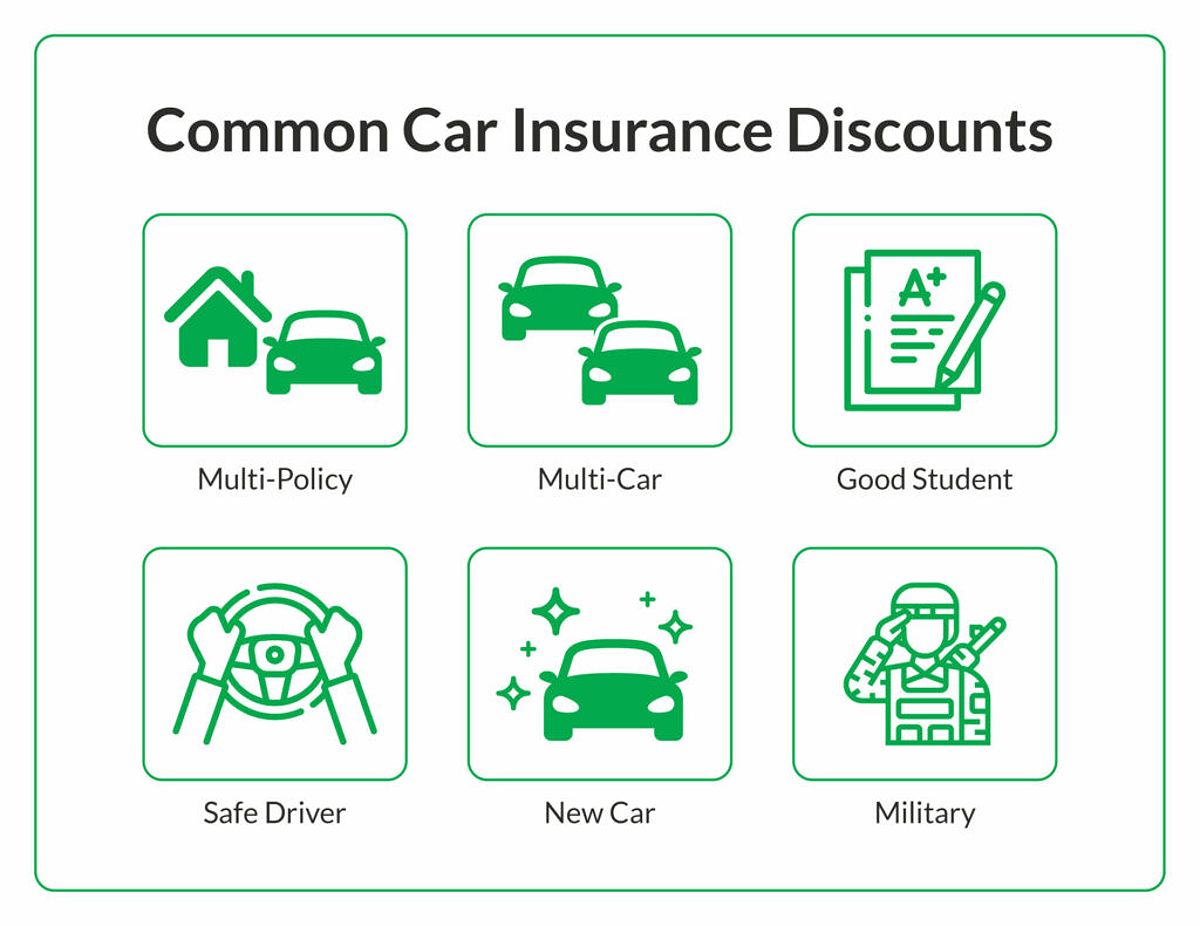

Look for Discounts

Many insurance providers offer discounts for bundling policies, implementing safety measures, or being a member of specific industry associations. Always inquire about available discounts to save on premiums. Taking advantage of these discounts can significantly lower your overall insurance costs.

Research Provider Reputation

Investigate reviews, ratings, and the financial stability of potential insurance providers. Partnering with a reliable and trustworthy company is crucial for your peace of mind. Look for providers with strong customer service ratings and a history of handling claims efficiently.

Working with an experienced insurance broker or agent can be invaluable during this process. They can provide personalized guidance and help you navigate the complexities of securing the best insurance for small business employees.

Top Business Liability Insurance Providers

When searching for the best business liability insurance, several top-rated providers consistently stand out in the industry:

Travelers Insurance

Travelers is an industry leader offering a wide range of liability coverage options for small businesses, including general, professional, and product liability. Their reputation for excellent customer service makes them a reliable choice. Travelers also provides helpful online resources to assist business owners in understanding their coverage needs.

The Hartford

The Hartford is known for its customizable business insurance solutions. They provide a variety of coverage options tailored to meet the unique needs of small businesses, along with outstanding customer support. Their user-friendly online platform allows for easy policy management and claims processing.

Chubb

Chubb is a global insurance powerhouse that offers comprehensive liability protection for companies of all sizes, focusing on high-value industries. Their extensive experience and financial strength make them a trusted provider. Chubb also offers specialized coverage options for unique business needs.

CNA

CNA excels in tailoring liability coverage to meet the unique needs of small and medium-sized businesses. Their dedication to customer satisfaction is reflected in their positive reviews. CNA also offers risk management resources to help businesses minimize potential liabilities.

Nationwide

Nationwide offers competitive rates and a user-friendly online platform for managing business liability insurance policies. They are a well-known name in the insurance industry, providing reliable coverage options. Nationwide also has a strong reputation for its claims handling process, ensuring that policyholders receive timely assistance.

When evaluating these and other providers, consider factors such as coverage breadth, pricing, customer satisfaction, and financial strength to find the best fit for your small business.

Frequently Asked Questions (FAQ)

Q: What are the most common types of claims filed against small businesses?

A: The most frequent claims against small businesses include slip-and-fall incidents, property damage, professional negligence, product defects, and employment-related issues like wrongful termination or discrimination. Understanding these common claims can help you assess your insurance needs.

Q: How much liability insurance should my small business have?

A: The amount of coverage you need depends on various factors, including your industry, risk profile, and business assets. Consulting with an insurance professional is the best way to determine the appropriate coverage limits for your specific needs.

Q: Can I get business liability insurance online?

A: Yes, many insurance providers offer online quoting and purchasing options for business liability coverage. However, discussing your needs with an experienced agent is recommended to ensure you secure the right protection for your small business.

Q: What are the benefits of working with an insurance broker?

A: An insurance broker can provide personalized guidance, help you navigate complex coverage options, and ensure you find the best business liability insurance tailored to your needs. Brokers have access to a wide range of providers and can often negotiate better rates on your behalf.

Q: What are some tips for reducing my business liability insurance costs?

A: To lower your insurance costs, consider increasing your deductible, bundling policies, implementing safety measures, and regularly reviewing your coverage needs to avoid overpaying for unnecessary coverage. Additionally, maintaining a clean claims history can help you secure lower premiums.

Conclusion

Securing the best business liability insurance is crucial for protecting your small business from financial ruin. By understanding your risks, comparing quotes from top providers, and choosing a reputable insurer, you can gain peace of mind knowing your company is adequately shielded from potential legal and financial challenges.

Don’t wait until it’s too late—contact a trusted insurance agent or broker today to discuss your business liability insurance needs and get personalized recommendations for the best coverage options. Get a free quote today and protect your business from unexpected risks! By investing in the right insurance, you’re not just protecting your business; you’re investing in your future and the financial freedom that comes with it.