Is Earnest Good For Student Loans? A Comprehensive Review

The student loan landscape is changing, with new players like Earnest offering a fresh perspective on lending. Earnest’s focus on responsible borrowing and financial stability sets it apart from traditional lenders, but it’s not without its limitations. While its refinancing program offers competitive rates and flexible terms, its private loan options may not be ideal for everyone. This guide will explore all aspects of Earnest’s offerings to help you determine is Earnest good for student loans.

Is Earnest Good for Student Loans? A Look at Refinancing for Recent Graduates

One of the key benefits of working with Earnest is their student loan refinancing program. Refinancing can be an excellent way for recent graduates to potentially lower their interest rates and monthly payments, making their debt more manageable.

Benefits of Refinancing with Earnest

Refinancing can offer several advantages:

- Lower Interest Rates: For instance, if you had a credit score of 680 when you initially took out your student loans and have since improved it to 750, refinancing with Earnest could potentially lower your interest rate by 0.5% to 1%, depending on your loan type and other factors. This seemingly small difference can translate to significant savings over the life of your loan.

- Reduced Monthly Payments: By extending the loan term or securing a lower interest rate, you can reduce your monthly payment, easing your financial burden.

- Consolidation of Loans: If you have multiple student loans, refinancing allows you to consolidate them into a single loan with one monthly payment.

The Refinancing Process

Earnest’s refinancing process is designed to be straightforward and borrower-friendly. They consider a range of factors, including:

- Credit History: A minimum credit score of 650 is required for refinancing.

- Income and Employment: Proof of stable income is essential to demonstrate your ability to repay the loan.

- Financial Stability: Earnest looks beyond just credit scores, evaluating your overall financial health, including savings and spending habits.

Key Features of Earnest’s Refinancing Program

Earnest offers several unique features that enhance the refinancing experience:

- Precision Pricing Model: Earnest’s Precision Pricing Model allows you to choose a loan term that aligns with your budget and repayment goals. For example, if you want to keep your monthly payments under $500, you can adjust the loan term accordingly, even if it means a slightly higher interest rate. This level of control gives you more flexibility than traditional lenders who typically offer fixed loan terms.

- Fixed and Variable Rate Options: As of September 2024, Earnest’s variable APRs range from 5.89% to 9.74%, while fixed APRs range from 4.89% to 9.74%. These rates are competitive within the industry and include a 0.25% discount for enrolling in automatic payments.

- No Cosigner Requirement: For recent graduates who may not have an established credit history, the absence of a cosigner requirement can be a significant advantage.

Exploring Earnests Private Student Loan Options

In addition to refinancing, Earnest also offers private student loans for undergraduate, graduate, and professional degree programs. While federal student aid should be the primary focus, private loans can be a useful tool for filling any remaining funding gaps.

The Role of Private Student Loans

Private student loans can be essential for students who:

- Have exhausted federal loan options and still need additional funding.

- Are pursuing degrees in fields with high tuition costs.

- Require funds for living expenses or other educational costs not covered by federal aid.

Key Features of Earnest’s Private Student Loans

Earnest’s private student loans come with several attractive features:

- Competitive Interest Rates: Interest rates for private loans range from 5.62% to 18.51% for variable APRs and 3.74% to 16.74% for fixed APRs (with the 0.25% autopay discount). These rates are competitive, especially when compared to traditional lenders.

- Generous Grace Period: This 9-month grace period gives you time to find a job, settle into your new life, and begin building your financial foundation before starting loan repayments. This can be particularly beneficial for graduates who may face a competitive job market or need time to adjust to their new responsibilities.

- Flexible Repayment Options: Earnest offers a range of flexible repayment options to fit your evolving financial needs. You can choose to defer payments while in school, opt for fixed monthly payments once you graduate, make interest-only payments during your grace period, or even start paying both principal and interest while still in school.

Eligibility Requirements

To be eligible for an Earnest loan, you must meet the following criteria:

- Be a U.S. citizen or permanent resident.

- Have a minimum credit score of 650 (or a co-signer with a 650+ score).

- Meet certain income and savings requirements, including a pattern of increasing bank account balances and low levels of non-essential debt.

Earnests Unique Underwriting Approach: More Than Just Credit Scores

One of the things that sets Earnest apart from other lenders is their focus on evaluating borrowers based on more than just their credit score.

A Holistic Evaluation Process

Earnest’s underwriting process is designed to identify borrowers who may not have a perfect credit history but demonstrate responsible financial management. This approach can be particularly beneficial for recent graduates who are just starting to build their credit history.

- Factors Considered:

- Income Stability: Earnest evaluates your income level and job stability, which can be more indicative of your ability to repay than credit scores alone.

- Savings History: A consistent pattern of saving money can demonstrate financial responsibility.

- Debt-to-Income Ratio: Earnest assesses your total debt in relation to your income, helping them gauge your overall financial health.

Earnests Borrower-Friendly Features and Protections

In addition to its flexible repayment options and underwriting approach, Earnest offers a few unique features and borrower protections that are worth highlighting.

Skip-a-Payment Program

One of the standout features is Earnest’s “Skip-a-Payment” program. Eligible borrowers can choose to skip one monthly payment per year without any penalties. This can be particularly helpful if you encounter unexpected financial challenges or need a temporary break from your loan payments.

Deferment and Forbearance Options

Earnest provides a range of deferment and forbearance options for both their refinancing and private student loans. These include:

- Deferment for Graduate School: If you decide to pursue further education, you can defer your payments without penalty.

- Military Service Deferment: Active military members can defer their loans.

- Economic Hardship Deferment: If you face financial difficulties, you may be eligible for deferment.

- Temporary Forbearance: In cases of involuntary unemployment or significant increases in essential expenses, Earnest offers temporary forbearance options.

Customer Service and Support

Another unique aspect of Earnest is their commitment to customer service. The company boasts a strong track record, with a 4.7 out of 5 rating on Trustpilot based on thousands of customer reviews. Earnest’s client happiness team is known for their responsiveness and dedication to resolving any issues that borrowers may face.

Earnests Referral Program: Sharing the Savings

One feature that sets Earnest apart from other student loan lenders is their referral program. Through this program, both the referring and referred borrowers can receive a $200 bonus when the referred borrower refinances their student loans with Earnest.

Benefits of the Referral Program

This referral program can be a great way for recent graduates to help their friends and family members save money on their student loan debt. By sharing their positive experiences with Earnest, graduates can potentially earn some extra cash while also supporting others in their financial journey.

The Rise of Fintech in Student Lending

The increasing popularity of fintech companies like Earnest in the student loan market reflects a broader trend towards innovation and user-friendly platforms in the lending industry. These companies often offer lower interest rates, more flexible repayment options, and a streamlined application process compared to traditional lenders.

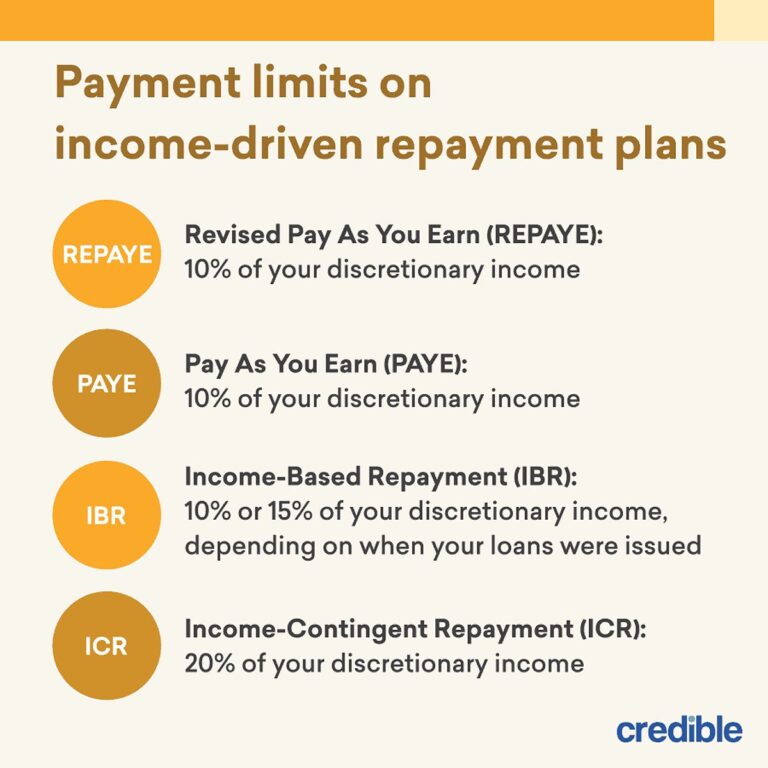

The Impact of the COVID-19 Pandemic on Student Loan Repayment

The federal student loan payment pause, which began in March 2020, was extended multiple times and is currently set to expire on October 1, 2024. The future of student loan repayments remains uncertain, with potential for further extensions or changes in repayment plans.

Is Earnest the Right Choice for You?

Ultimately, whether Earnest is the right lender for you will depend on your unique financial situation and goals.

Key Advantages of Choosing Earnest

- Competitive Interest Rates: According to a recent study by the Federal Reserve, the average interest rate on student loans was 5.2% in 2023. Refinancing with Earnest could potentially lower this rate to 4.5% or even lower, depending on your credit score and loan type.

- Flexible Repayment Terms: The ability to customize your loan length and repayment plan can make managing your debt easier.

- Generous Grace Periods: The 9-month grace period after graduation provides crucial financial flexibility.

- Focus on Financial Stability: Earnest’s unique underwriting process can benefit borrowers with limited credit history.

- Unique Borrower Protections: Features like the “Skip-a-Payment” program and deferment options provide added peace of mind.

Limitations to Consider

However, it’s important to note that Earnest does have some limitations:

- No Cosigner Release Options: Earnest does not offer cosigner release options for their private loans. If you have a cosigner on your loan, you would need to refinance with Earnest or another lender to potentially remove the cosigner.

- Variable Rates: While Earnest offers competitive variable rates, these rates can potentially increase over time, which could lead to higher payments in the future.

- Availability: Earnest’s services are not available in all states, so you’ll need to check their coverage area.

Frequently Asked Questions

Q: What is Earnest’s minimum credit score requirement for student loan refinancing?

A: Earnest’s minimum credit score requirement for refinancing is 650 for borrowers with a completed degree. However, borrowers with incomplete degrees may need a credit score of at least 700 to qualify.

Q: Does Earnest offer cosigner release options for private student loans?

A: No, Earnest does not offer cosigner release options for their private student loans. If you have a cosigner on your loan, you would need to refinance with Earnest or another lender to potentially remove the cosigner.

Q: What are Earnest’s customer service hours?

A: Earnest’s customer service is available Monday through Friday, from 8 AM to 5 PM PST. You can reach their team by phone, email, or live chat.

Q: Can I refinance an Earnest loan?

A: Yes, you can refinance an Earnest student loan or a student loan from another private lender. There is no limit to the number of times a borrower may refinance with Earnest.

Conclusion

Earnest can be a valuable option for recent graduates seeking to refinance their student loans or obtain private student loans. Their focus on financial stability beyond credit scores, flexible repayment options, and unique borrower protections make them a competitive choice in the student loan market. However, it’s crucial to compare Earnest’s offerings with other lenders to ensure you’re getting the best rates and terms for your individual needs.

As you navigate your student loan options, remember to carefully evaluate your financial situation and explore all available options before making a decision. Start your journey towards financial freedom by researching and comparing student loan options today. Whether you decide to go with Earnest or another lender, being informed and proactive about your choices will empower you to take control of your financial future.