Unlocking Freedom: Strategies To Help Pay Off Private Student Loans After Graduation

The rising cost of higher education has led many students to rely on private loans, which often carry higher interest rates and fewer borrower protections than their federal counterparts. Navigating this landscape can be daunting, but understanding the available options and strategies can empower borrowers to take control of their financial future. This article examines various approaches to help paying off private student loans, from refinancing and consolidation to budgeting techniques and seeking professional guidance.

Understanding Private Student Loan Debt

Private student loans differ significantly from federal student loans in terms of interest rates, repayment options, and borrower protections. Here’s a closer look at these differences:

-

Higher Interest Rates: Private loans typically come with interest rates that can be considerably higher than those of federal loans. This can lead to larger monthly payments and a greater total cost over the life of the loan. For instance, while federal loans may offer rates around 4-7%, private loans can range from 6% to over 12%, depending on the borrower’s creditworthiness.

-

Limited Borrower Protections: Unlike federal loans, private loans often lack flexible repayment plans and options for deferment or forbearance. Borrowers may find themselves without a safety net during financial hardships, making it crucial to understand the terms and conditions of their loans before signing.

-

Prevalence of Private Loans: Recent statistics indicate that private student loans make up about 8% of the staggering $1.8 trillion in total student debt in the United States. This staggering figure highlights the significant financial burden many graduates face as they navigate their financial obligations in an increasingly competitive job market.

The implications of high-interest rates and limited repayment options can be severe, often leading to prolonged debt and financial instability. Understanding these aspects is crucial for anyone seeking help paying off private student loans.

Benefits of Refinancing to Help Paying Off Private Student Loans

Refinancing is one of the most effective strategies for managing private student loan debt. This process involves replacing your existing loans with a new loan, ideally at a lower interest rate. Here’s how refinancing can help:

Benefits of Refinancing

- Lower Interest Rates: By refinancing, you may secure a reduced interest rate, which translates to lower monthly payments and substantial savings over time. This can be particularly beneficial for those who have improved their credit score since taking out their original loans.

-

Flexible Repayment Terms: Some lenders offer more favorable repayment terms, such as longer repayment periods or the option to switch from a variable to a fixed interest rate. This flexibility can help you tailor your repayment plan to fit your financial situation.

-

Simplified Payments: If you have multiple loans, refinancing can consolidate them into a single monthly payment, making it easier to manage your debt. This not only streamlines your finances but also reduces the likelihood of missing payments.

Factors Influencing Refinancing

When considering refinancing, several factors will influence your eligibility and potential interest rates:

-

Credit Score: A higher credit score typically results in better refinancing offers. It’s advisable to check your credit report and improve your score if necessary before applying. Many lenders require a minimum score of 650 to qualify for refinancing.

-

Income: Lenders will assess your income to ensure you can handle the new loan payments. A stable income can strengthen your application, as lenders want to see that you have the means to repay the loan.

-

Existing Loan Balances: The total amount of debt you currently owe will also play a role in determining your refinancing options. Lenders often prefer borrowers with manageable debt-to-income ratios.

Potential Drawbacks

While refinancing can provide significant benefits, it’s essential to consider the potential downsides:

-

Loss of Protections: Refinancing may eliminate certain borrower protections, such as eligibility for federal loan forgiveness programs. If you initially took out federal loans, refinancing into a private loan may mean losing access to income-driven repayment plans.

-

Fees and Costs: Some lenders charge fees for refinancing, which can offset the potential savings. Before committing to refinancing, carefully review the loan agreement, paying attention to any fees, interest rates, and repayment terms.

To find the best refinancing option, compare rates and terms from multiple lenders. Websites that aggregate loan offers, like Credible or LendingTree, can be particularly useful for this purpose. These platforms allow you to input your loan details and receive personalized offers from various lenders, enabling a side-by-side comparison of interest rates, repayment terms, and fees.

Debt Relief Options

In addition to refinancing, there are several other strategies you can consider to help pay off private student loans:

Loan Consolidation

Loan consolidation involves combining multiple private loans into one. This can simplify your repayment process by:

-

Reducing Monthly Payments: A single loan may come with a lower interest rate, thus lowering your monthly payments. This can be particularly helpful for those juggling multiple loans with varying interest rates. However, it’s important to note that consolidation can sometimes lead to a higher overall interest rate if the weighted average of your original loan rates is lower than the new rate offered.

-

Streamlining Payments: Managing one payment instead of multiple loans can make budgeting easier. It can also reduce the cognitive load associated with keeping track of different due dates and amounts.

State-Sponsored Repayment Assistance Programs

Many states offer repayment assistance programs aimed at specific professions, such as teaching, nursing, or public service. These programs can provide financial aid to help reduce your student loan balance. For example, some states may offer loan repayment assistance to healthcare professionals working in underserved areas.

- Eligibility Requirements: Each program will have its own eligibility criteria, so it’s essential to research what’s available in your state and whether you qualify.

- Application Process: Be prepared to submit documentation of your employment and loan details. Some programs require proof of service in a designated field or area.

Income-Driven Repayment Plans

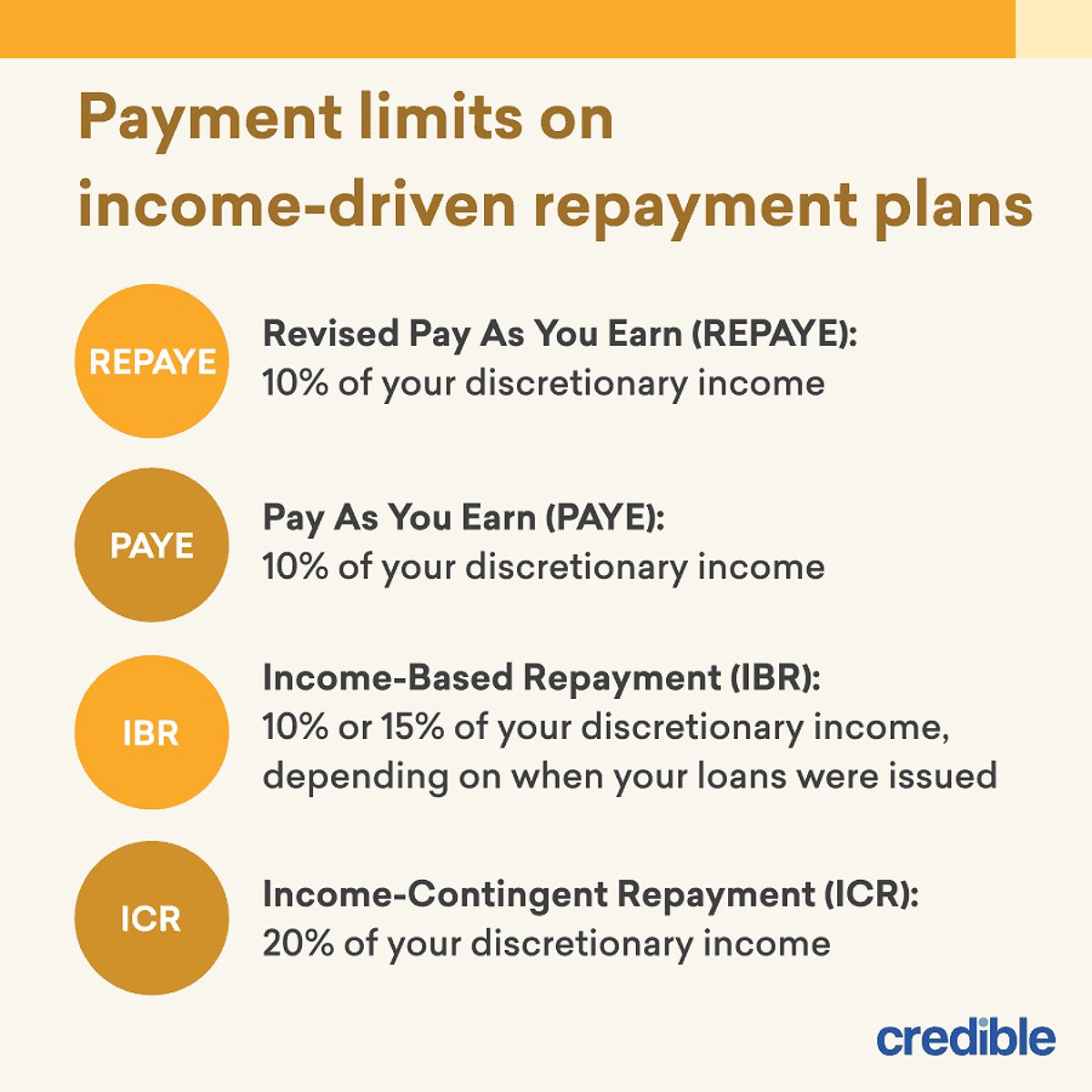

While primarily associated with federal loans, income-driven repayment plans are gaining popularity among private lenders. According to a recent study by the National Association of Student Financial Aid Administrators (NASFAA), approximately 25% of private lenders now offer income-driven repayment options. These plans adjust your monthly payment based on your income, making your loans more manageable during financial hardships.

-

Payment Caps: Income-driven plans typically cap your monthly payments at a percentage of your discretionary income, making it easier to budget your finances.

-

Eligibility Criteria: Not all private lenders offer this option, so it’s essential to ask about it upfront. Some private lenders, such as SoFi or Sallie Mae, now provide income-driven repayment plans.

Managing Your Student Loan Debt

Effective debt management is crucial in your journey to pay off private student loans. Here are key steps to consider:

Create a Budget

Developing a comprehensive budget that prioritizes your student loan payments is essential. A well-structured budget helps you:

-

Track Expenses: By understanding where your money goes, you can identify areas to cut back and allocate more towards your loans. Consider using budgeting apps that can help visualize your spending and savings.

-

Avoid Missed Payments: Consistently allocating funds for your loans can help you avoid late fees and negative impacts on your credit score. Set reminders for payment due dates to ensure you stay on track.

Automate Your Loan Payments

Automating your loan payments can significantly reduce the risk of missed payments and late fees. Many lenders allow you to set up automatic payments from your checking account, ensuring that your payments are made on time each month. This can free up your time and mental energy, allowing you to focus on other financial goals.

Negotiate with Your Lender

If you’re experiencing financial difficulties, don’t hesitate to reach out to your lender. Many private lenders are willing to work with borrowers facing hardship. Options may include:

-

Temporary Deferment or Forbearance: These options allow you to pause payments for a limited time without defaulting on your loan. However, interest may continue to accrue during this period, so it’s essential to understand the long-term implications.

-

Interest-Only Payments: Some lenders may offer the option to make interest-only payments temporarily, reducing your financial burden. This can be a helpful short-term solution while you work on improving your financial situation.

Seek Professional Guidance

Consider consulting a financial advisor or a student loan counselor for personalized guidance. These professionals can help you:

-

Navigate Complexities: They can explain your repayment options and help you develop a financial plan tailored to your needs. Their expertise can provide peace of mind during a stressful time.

-

Explore Debt Relief Strategies: Professional guidance can uncover potential strategies you may not have considered. They can also assist in negotiating with lenders on your behalf.

Frequently Asked Questions

Can I get my private student loans forgiven?

While private student loans are generally not eligible for federal forgiveness programs, certain state-specific programs, such as the Teacher Loan Forgiveness Program or the Public Service Loan Forgiveness Program, may offer options for debt relief. However, borrowers should thoroughly research and confirm the availability of these programs for their specific loans.

What if I can’t afford my student loan payments?

If you find yourself unable to make payments, contact your lender immediately. They may provide options such as deferment, forbearance, or interest-only payments to help you manage your financial situation. Proactive communication can often lead to more favorable outcomes.

How can I find a reputable student loan counselor?

Look for resources from the U.S. Department of Education’s Federal Student Aid portal or the National Association of Student Financial Aid Administrators (NASFAA) for guidance on finding qualified professionals. Ensure that any counselor you consider is certified and has a good reputation.

Are there any scams I should be aware of?

Be cautious of unsolicited offers promising debt forgiveness or assistance that requires upfront fees. Rely on reputable sources for legitimate help paying off private student loans. Always research companies and read reviews before engaging with them.

Conclusion

Tackling private student loan debt can be challenging, but with the right strategies and resources, you can take control of your financial future. By understanding the unique challenges posed by private loans, exploring refinancing and consolidation options, and leveraging alternative debt relief programs, you can lighten your financial burden and pave the way for greater financial freedom.

Remember, you are not alone in this journey. Seek guidance from financial professionals, stay vigilant against scams, and remain persistent in your efforts to pay off your private student loans. Each step you take towards repayment brings you closer to a future free from the weight of student loan debt, allowing you to pursue your dreams and financial goals.