Car Insurance Quotes Colorado Springs: A Comprehensive Guide

Turning 18 or 21 in Colorado Springs? Congratulations! But before you hit the road, you need to secure the right car insurance coverage. And let’s be honest, finding affordable auto insurance quotes in Colorado Springs can be a daunting task, especially for young drivers. This guide will equip you with the knowledge and strategies to navigate the car insurance landscape in Colorado Springs and secure the best rates that fit your needs.

Understanding Car Insurance Quotes in Colorado Springs

Colorado’s Minimum Insurance Requirements

In Colorado, all drivers are required to carry liability insurance that includes at least $25,000 in bodily injury coverage per person, $50,000 in bodily injury coverage per accident, and $15,000 in property damage coverage. Failing to maintain this minimum coverage can result in penalties, license suspension, and points on your driving record. Understanding these requirements is crucial, as they form the baseline for any car insurance policy you consider.

The Importance of Car Insurance

Car insurance is not just a legal requirement; it serves as a financial safety net. In the event of an accident, having adequate coverage can protect you from significant out-of-pocket expenses. Whether you’re involved in a minor fender bender or a major collision, the costs can quickly escalate. Therefore, securing the right car insurance quotes in Colorado Springs is vital for your financial well-being.

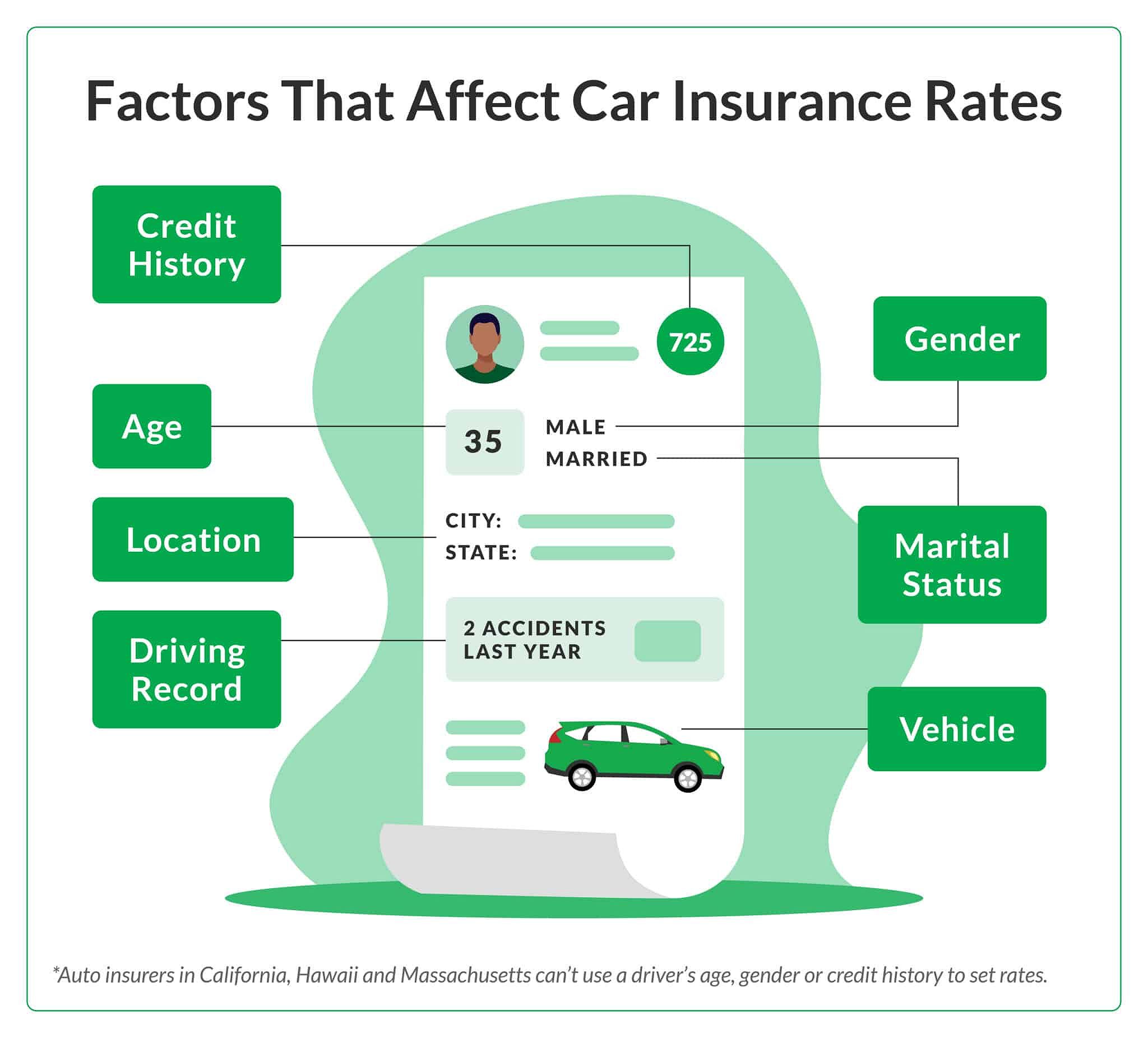

Factors Affecting Your Car Insurance Rates

Age

As a young driver, particularly under the age of 25, you’re likely to face higher premiums due to your lack of experience behind the wheel and elevated accident risk. Insurance companies often categorize young drivers as high-risk, which can lead to increased costs. However, as you gain experience and maintain a clean driving record, you may see your rates decrease over time.

Driving History

Your driving record plays a significant role in determining your car insurance rates. Speeding tickets in Colorado Springs can result in a 20% increase in your premium, while a DUI can lead to a 50% increase. Insurers view these infractions as indicators of risky behavior, which can lead to higher costs. On the flip side, maintaining a clean record can help you qualify for discounts and lower rates in the future.

Vehicle

The make, model, and year of your car, as well as its safety features, can affect your insurance costs. Vehicles with higher repair and replacement expenses typically have higher insurance rates. For instance, a sports car might attract higher premiums compared to a sedan with good safety ratings. Additionally, newer vehicles equipped with advanced safety features like lane departure warning and automatic emergency braking often qualify for discounts.

Location

Where you live in Colorado Springs can impact your auto insurance quotes. In Colorado Springs, areas like Old Colorado City with a high concentration of historic homes and pedestrian traffic might see higher insurance rates due to a higher risk of property damage. If you live in a neighborhood known for its high crime rate, you might face increased premiums. Conversely, living in a safer area could help you secure lower rates.

Credit Score

Surprisingly, your credit score can also influence your car insurance quotes. Drivers with lower credit scores often pay more for coverage. Insurers use credit scores as a predictive tool to assess risk; therefore, maintaining a good credit score can lead to more favorable insurance rates. If your credit score has improved, it may be worth revisiting your insurance provider to negotiate better terms.

Understanding Different Types of Coverage

When searching for car insurance quotes in Colorado Springs, it’s essential to understand the various types of coverage available:

- Liability Coverage: This is the minimum required coverage in Colorado, which pays for damages to others if you are at fault in an accident.

- Collision Coverage: This type of insurance covers damage to your vehicle resulting from a collision with another vehicle or object, regardless of fault.

- Comprehensive Coverage: This protects against non-collision-related incidents, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage is particularly important in Colorado Springs, where approximately 10% of drivers are uninsured, according to the Colorado Department of Motor Vehicles. This protects you if you’re involved in an accident with a driver who doesn’t have insurance or whose insurance is insufficient to cover your damages.

- Medical Payments Coverage: This pays for medical expenses for you and your passengers after an accident, regardless of fault, and is separate from your health insurance.

Understanding these coverage options will help you make informed decisions and tailor your policy to your specific needs.

Finding Affordable Car Insurance Quotes in Colorado Springs

Comparing Quotes: Your Best Tool

When it comes to securing the best car insurance rates in Colorado Springs, comparing quotes from multiple providers is crucial. This can be time-consuming, but it’s the best way to ensure you’re getting the most competitive and comprehensive coverage for your needs. Online comparison tools like Jerry can streamline this process, allowing you to quickly gather quotes from top insurance companies in Colorado Springs.

Top Car Insurance Companies for Young Drivers

Some of the best car insurance companies for young drivers in Colorado Springs include:

- Geico: Known for its competitive rates and user-friendly online services.

- State Farm: Offers a range of discounts, particularly for safe driving and bundling policies.

- Progressive: Provides flexible coverage options and a variety of discounts, including those for students.

- Allstate: Offers unique features like accident forgiveness and a wide range of coverage options.

These providers have a reputation for offering affordable rates and quality coverage for young drivers in the area.

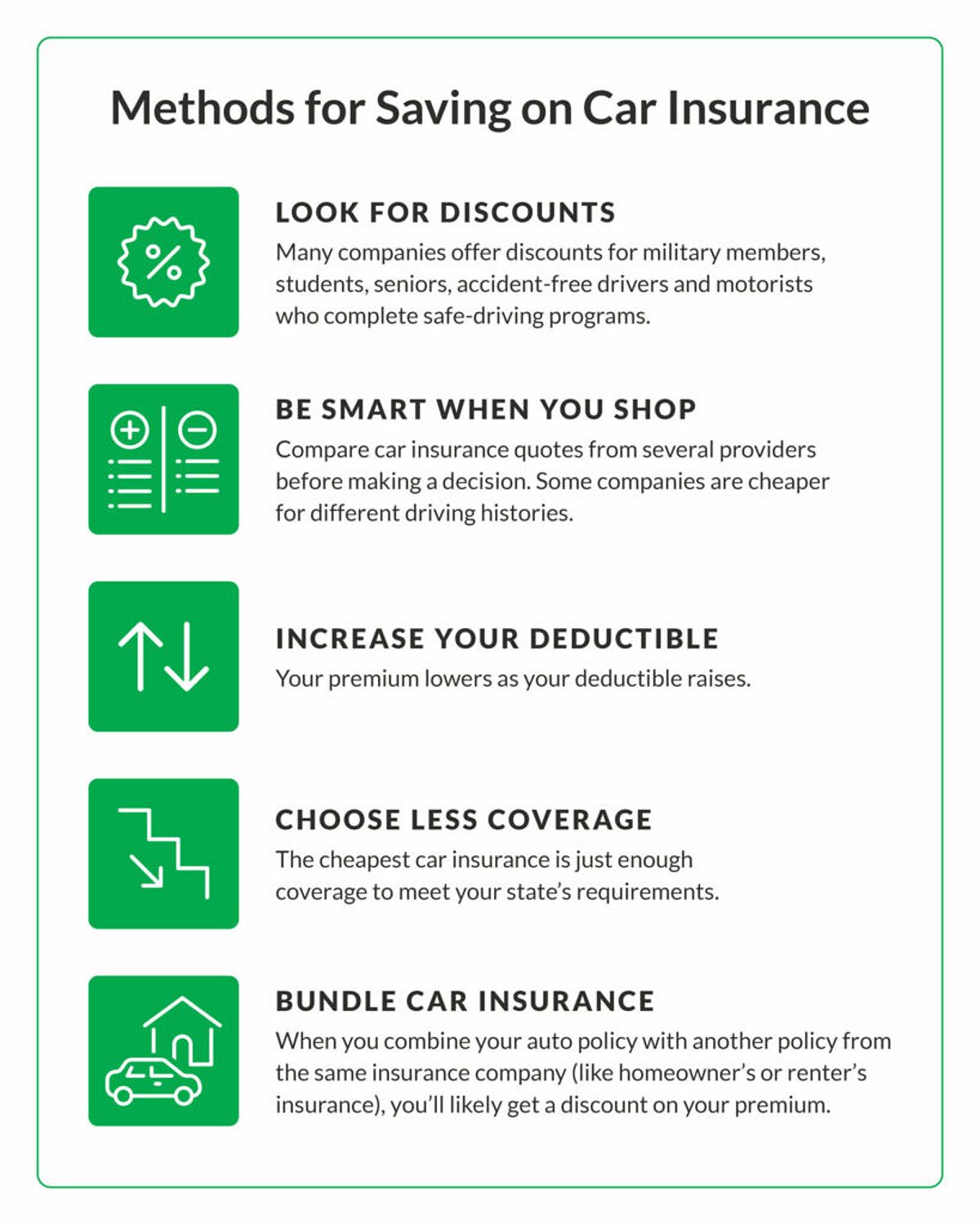

Discounts for Young Drivers

Young drivers in Colorado Springs can take advantage of several discounts to lower their car insurance costs:

- Good Student Discount: Maintaining a strong academic record (often a B average or higher) can qualify you for a discount from many insurers.

- Defensive Driving Course Discount: Completing an approved defensive driving course can demonstrate your commitment to safe driving and may lead to premium reductions.

- Multi-Car Discount: If your family has multiple vehicles insured with the same provider, you may be eligible for a multi-car discount.

- Bundling Discount: Combining your car insurance with other policies, such as homeowners or renters insurance, can often result in significant savings.

- Low Mileage Discount: If you don’t drive much, some insurers offer discounts for low mileage, recognizing that less time on the road means less risk.

Be sure to inquire about all available discounts to ensure you’re taking advantage of every opportunity to save on your auto insurance in Colorado Springs.

Tips for Saving Money on Car Insurance in Colorado Springs

Maintain a Clean Driving Record

Avoiding speeding tickets, accidents, and DUIs is crucial for keeping your car insurance rates low. Even a single infraction can lead to a substantial increase in your premiums. Safe driving habits not only protect you and others on the road but also help you maintain lower insurance costs.

Choose a Safe Vehicle

When selecting a car, consider models with good safety ratings and anti-theft features. These factors can often translate to lower insurance costs. Research vehicles that are known for their safety and reliability, as these tend to attract lower premiums.

Increase Your Deductible

Raising your deductible (the amount you pay out-of-pocket before your insurance coverage kicks in) can lower your monthly premiums. However, ensure you have the financial means to cover a higher deductible if needed. This strategy can be especially beneficial for young drivers who may have limited budgets.

Explore Telematics Programs

Many insurance companies in Colorado Springs now offer usage-based insurance programs, where your driving habits are tracked through a mobile app or device, potentially leading to discounts for safe driving. If you are a conscientious driver, enrolling in a telematics program can be a smart move.

Review Your Policy Regularly

Don’t just set it and forget it. Periodically reviewing your car insurance policy and comparing quotes can help ensure you’re still getting the best rates and coverage for your needs. Life changes, such as moving, getting married, or changing jobs, can all impact your insurance needs.

Pay Attention to Renewal Rates

When your policy is up for renewal, be sure to check if your rates have increased. Sometimes, insurers raise rates without notifying you, so it’s important to stay vigilant. If you notice a significant increase, consider shopping around for new quotes to find better options.

Leverage Technology

In today’s digital age, various apps and websites can help you track your driving habits and find better insurance rates. Utilizing these tools can provide insights into your driving behavior and help you make informed decisions about your coverage.

Frequently Asked Questions

What are the minimum car insurance requirements in Colorado?

In Colorado, all drivers must carry liability insurance with at least $25,000 in bodily injury coverage per person, $50,000 in bodily injury coverage per accident, and $15,000 in property damage coverage.

How can I lower my car insurance costs as a young driver in Colorado Springs?

As a young driver, you can lower your auto insurance costs by maintaining a clean driving record, choosing a safe vehicle, considering a higher deductible, and exploring telematics programs that track your driving behavior.

What are some reputable car insurance companies in Colorado Springs?

Some of the top-rated car insurance providers in Colorado Springs include Geico, State Farm, Progressive, and Allstate. These companies are known for offering competitive rates and comprehensive coverage options.

How can I compare car insurance quotes online in Colorado Springs?

You can use online comparison tools like Jerry to quickly gather and compare car insurance quotes from multiple providers in Colorado Springs. This allows you to find the most affordable coverage that meets your needs.

Are there special discounts for young drivers in Colorado Springs?

Yes, many insurance providers offer discounts specifically for young drivers, including good student discounts, defensive driving course discounts, and multi-car discounts for families.

Conclusion

Navigating the car insurance landscape in Colorado Springs can be a daunting task, especially for young drivers, who are often bombarded with confusing terminology and endless options. However, with the right strategies and knowledge, you can secure the best auto insurance quotes for your specific needs. By understanding the key factors that influence your rates, taking advantage of available discounts, and regularly comparing quotes, you can find affordable coverage that provides the protection you require while staying within your budget. Start your search today and hit the road with confidence in Colorado Springs. With careful planning and informed decisions, you can enjoy the freedom of driving without the burden of excessive insurance costs.