Essential Business Insurance For Restaurants: Protect Your Dream With The Right Coverage

You’ve poured your heart and soul into creating the perfect dining experience, but have you considered the financial implications of a customer’s allergic reaction? Restaurants face a unique set of risks, and while many focus on crafting the ideal menu, a lack of adequate business insurance for restaurants can quickly turn a thriving establishment into a financial nightmare.

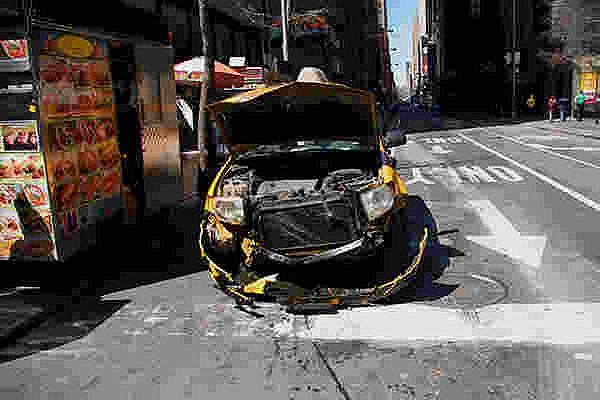

The reality is that a single incident, such as a slip-and-fall accident or a devastating fire, can have severe consequences for your restaurant. That’s where business insurance for restaurants comes into play, providing a crucial layer of protection to safeguard your dream and ensure your continued success.

Understanding the Unique Risks Facing Restaurants

Restaurants operate in a dynamic environment, where the combination of food preparation, customer traffic, and often the serving of alcohol creates a complex web of potential liabilities. According to the National Fire Protection Association, an average of 7,000 restaurant fires occur each year in the United States, causing an estimated $100 million in property damage. These alarming statistics serve as a stark reminder of the inherent risks involved in running a restaurant.

Beyond the physical risks, restaurants also face a heightened threat of lawsuits. A customer who slips on a wet floor, contracts food poisoning, or is involved in an alcohol-related incident can file costly claims that could devastate your business. Without the right insurance in place, you could be forced to pay for these claims out of pocket, potentially draining your resources and jeopardizing your restaurant’s future.

Business Insurance for Restaurants: Comprehensive Coverage for Your Success

To protect your restaurant from these various risks, it’s crucial to have the right insurance coverage in place. Let’s explore the key policies every restaurant owner should consider:

General Liability Insurance

This is the cornerstone of any restaurant’s insurance portfolio. General liability insurance for restaurants provides coverage for third-party injuries and property damage, helping to cover the costs of medical bills, legal fees, and settlements if a customer or bystander is injured on your premises. It’s a crucial safeguard against the unexpected, whether it’s a customer who slips on a wet floor or an incident involving food contamination.

Having adequate general liability insurance for restaurants not only protects your financial interests but also enhances your restaurant’s credibility. Many customers prefer dining at establishments that demonstrate a commitment to safety and responsibility. This coverage can also be a requirement when entering into contracts with vendors or landlords, making it an essential part of your business strategy.

Restaurant Property Insurance

Your restaurant’s physical assets, from the building itself to the kitchen equipment and furnishings, are essential to your business operations. Property insurance protects these investments by covering the cost of repairs or replacement in the event of a fire, natural disaster, theft, or other covered perils. This coverage can help you get back on your feet quickly after a catastrophic event.

Imagine the devastating impact of a fire destroying your kitchen equipment or a flood ruining your dining area. Without proper property insurance, the financial burden of replacing these essential assets could cripple your business. Additionally, this type of insurance can cover business personal property, such as furniture and inventory, ensuring that your entire operation is safeguarded.

Liquor Liability Insurance

If your restaurant serves alcoholic beverages, liquor liability insurance is a must-have. This coverage protects your business from the financial consequences of alcohol-related incidents, such as a customer who becomes intoxicated and injures themselves or others. It can help cover legal fees, court costs, and settlements, shielding your restaurant from potentially ruinous liability claims.

Understanding the importance of liquor liability insurance is crucial, especially in an industry where alcohol plays a significant role in customer enjoyment. Many states have strict laws regarding the service of alcohol, and failure to comply can result in hefty fines or even the loss of your liquor license. Having this coverage not only protects your finances but also ensures compliance with local regulations.

Workers’ Compensation Insurance

Most states require restaurants to carry workers’ compensation insurance, which provides benefits to employees who are injured or become ill on the job. This coverage can help cover medical expenses, lost wages, and other costs associated with work-related incidents, safeguarding your staff and your business.

In the bustling environment of a restaurant, accidents can happen. From kitchen injuries to slip-and-fall accidents in the dining area, workers’ compensation insurance is vital for protecting your employees and your business. Additionally, this coverage can help foster a positive workplace culture, demonstrating your commitment to employee well-being and safety.

Food Contamination Insurance

Restaurants are particularly vulnerable to food-related incidents, whether it’s a supplier-related issue or an in-house mistake. Food contamination insurance can help protect your business by covering the costs of a food recall, spoiled inventory, and any resulting lawsuits or lost revenue.

The financial implications of a foodborne illness outbreak can be catastrophic. Not only do you face the cost of recalls and legal fees, but your restaurant’s reputation can also suffer, leading to a decline in customer trust and business. Food contamination insurance acts as a financial safety net, ensuring that your restaurant can recover from such incidents without facing overwhelming losses.

Business Interruption Insurance

Unexpected events like fires, floods, or equipment breakdowns can force your restaurant to temporarily close, disrupting your operations and revenue. Business interruption insurance can help bridge the gap, providing funds to cover lost income, ongoing expenses, and the costs of getting your business back up and running.

This type of insurance is particularly important for restaurants, as a prolonged closure can lead to significant financial strain. By having business interruption insurance in place, you can ensure that your restaurant has the resources to navigate through challenging times and emerge stronger on the other side.

Commercial Auto Insurance

If your restaurant operates delivery vehicles or catering services, commercial auto insurance is a necessity. This coverage protects your business from the financial consequences of accidents, including property damage, medical expenses, and legal liability.

Whether you’re delivering meals to customers or transporting catering supplies, having commercial auto insurance is essential for protecting your business assets. Without this coverage, a single accident could result in substantial financial losses that could jeopardize your restaurant’s future.

Employment Practices Liability Insurance (EPLI)

Managing a team of employees brings its own set of risks, including claims of discrimination, harassment, or wrongful termination. EPLI can help safeguard your restaurant against the costs of defending these types of lawsuits, preserving your business reputation and financial stability.

In today’s workplace, it’s crucial to foster an environment of respect and fairness. EPLI not only provides financial protection but also encourages best practices in employee management. By investing in this coverage, you demonstrate your commitment to a positive workplace culture.

Beyond General Liability: Tailoring Coverage for Your Restaurants Specific Needs

While general liability is a foundational policy, restaurants often need specialized coverage based on their unique operations. For example, a restaurant offering catering services should consider adding commercial auto insurance to cover accidents involving their delivery vehicles. Similarly, a restaurant with a large outdoor dining area might benefit from umbrella liability insurance to provide additional protection beyond standard limits.

Partnering with the Right Insurance Provider

When it comes to protecting your restaurant, it’s essential to work with an insurance provider who understands the unique challenges and risks you face. Look for a provider with extensive experience in the food and beverage industry, as they’ll be better equipped to assess your needs and craft a tailored insurance package.

Additionally, be sure to compare quotes from multiple providers to ensure you’re getting the best value for your money. While cost is certainly a factor, it’s crucial to balance affordability with comprehensive coverage that meets the specific needs of your restaurant. Don’t hesitate to ask potential providers about their experience with restaurants and their understanding of the industry’s specific risks.

Proactive Risk Management Strategies for Restaurants

While insurance is a crucial safeguard, proactive risk management can also help reduce the likelihood of claims and keep your insurance costs in check. By implementing best practices in areas like food safety, employee training, and responsible alcohol service, you can demonstrate your commitment to mitigating risks and potentially lower your insurance premiums.

Food Safety and Handling

Implement stringent food safety protocols, provide comprehensive training for your staff, and conduct regular inspections to ensure your kitchen and food preparation areas meet the highest standards of cleanliness and hygiene. This can help prevent foodborne illness outbreaks and protect your reputation.

Slip-and-Fall Prevention

Maintain clean, well-lit, and properly signposted floors to minimize the risk of slips, trips, and falls. Regularly inspect your premises for potential hazards and address them promptly to keep your customers and staff safe.

Employee Safety and Training

Prioritize employee safety by providing comprehensive training on the proper use of equipment, safety procedures, and customer service best practices. This can help reduce the risk of workplace injuries and ensure your staff is equipped to handle any situation that may arise.

Responsible Alcohol Service

If your restaurant serves alcohol, implement strict policies and training protocols to ensure your staff follows responsible serving practices. This includes verifying customers’ ages, monitoring intoxication levels, and refusing service to those who appear impaired.

By proactively addressing these risk areas, you can not only protect your restaurant but also potentially lower your insurance premiums by demonstrating your commitment to safety and risk management.

Current Trends Affecting Restaurant Insurance Needs

The restaurant industry is evolving, and so are the risks. The rise of food delivery platforms has led to increased liability concerns for restaurants, as they now face potential claims related to food safety, delivery driver accidents, and data breaches. Restaurants should consider adding cyber liability insurance to protect their data and systems.

Another emerging trend is the growing popularity of farm-to-table dining, which presents unique challenges for restaurants. Sourcing ingredients directly from farms can increase the risk of food contamination, making food contamination insurance even more crucial.

FAQ

Q: What is the average cost of restaurant insurance?

A: The cost of restaurant insurance can vary widely, depending on factors such as your location, the size of your establishment, the type of cuisine you serve, whether you serve alcohol, and your claims history. On average, you can expect to pay between $1,000 to $10,000 annually for a comprehensive insurance package.

Q: What are the most common restaurant insurance claims?

A: The most common restaurant insurance claims include slip-and-fall incidents, foodborne illness outbreaks, property damage (e.g., fire, water damage, theft), employee injuries, and alcohol-related incidents.

Q: How can I find a reputable insurance broker or agent?

A: Start by asking for referrals from other restaurant owners, industry associations, or online review sites. Look for brokers or agents who specialize in the restaurant industry and have a track record of providing exceptional service and tailored coverage solutions.

Conclusion: Protecting Your Restaurants Future with Comprehensive Insurance

Owning a restaurant is a dream come true for many, but it also comes with a unique set of risks that require careful planning and protection. By investing in comprehensive business insurance for restaurants, you can safeguard your investment, minimize financial exposure, and focus on what you do best: crafting an exceptional dining experience for your customers.

Take the time to research your options, compare coverage and costs, and work with an insurance provider who understands the specific needs of the restaurant industry. With the right insurance policies in place, you can rest assured that your restaurant is prepared to weather any storm and continue serving your community for years to come.