Usaa Auto Insurance Usaa Quote: Access Exclusive Military Discounts And Benefits

Deployment can be a stressful time for military members, especially when it comes to managing car insurance. USAA, a company dedicated to serving the military community, offers exclusive discounts and benefits to help ease this financial burden. Getting an auto insurance USAA quote is a simple process that can be completed online or through their mobile app, allowing you to explore options and find the best coverage tailored to your specific needs.

Unlock Exclusive Savings with USAA Auto Insurance

For active duty and retired military members, finding affordable car insurance that meets unique requirements is essential. USAA stands out as a provider that truly understands the challenges of military life, offering a range of exclusive discounts and benefits specifically designed to support service members and their families. In this comprehensive guide, we will delve into the advantages of obtaining a USAA auto quote insurance, how to get your quote, the coverage options available, and the claims process.

Discover the Advantages of USAA Auto Insurance

Founded in 1922 by a group of Army officers seeking to insure each other’s vehicles, USAA has a long and unwavering commitment to serving the military community. Today, the company boasts a strong financial standing with an A++ (Superior) rating from AM Best and consistently ranks among the highest in customer satisfaction surveys. This reputation reflects USAA’s dedication to providing exceptional service to military families.

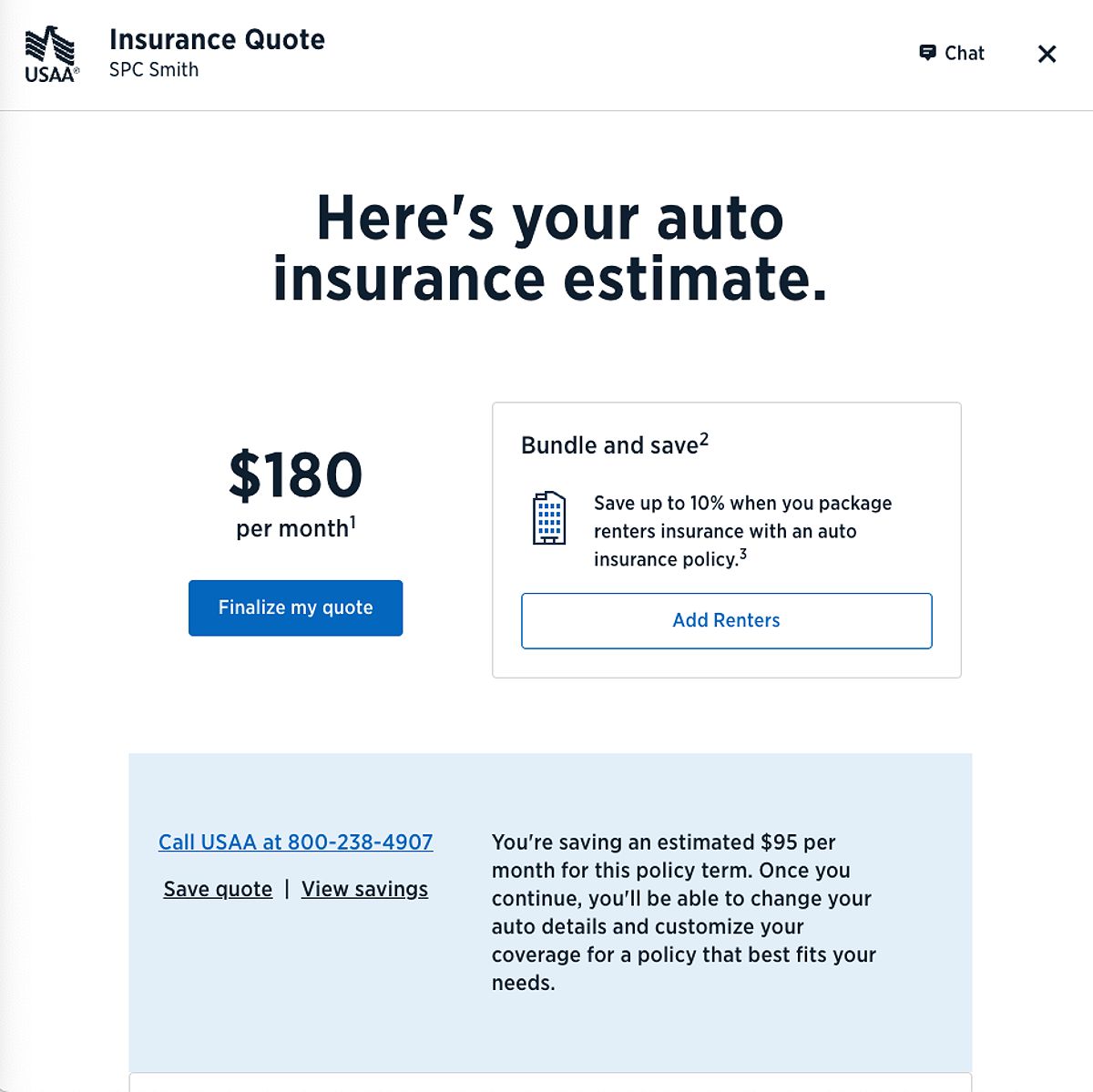

One of the primary advantages of choosing USAA for your auto insurance is the potential for significant cost savings. Their average rates are often well below the national average, with full coverage policies coming in at around $84 per month—less than half the typical $173 monthly premium. This makes USAA an incredibly attractive option for budget-conscious military members looking to maximize their savings.

Exclusive Discounts and Benefits for Military Members

USAA offers a range of discounts specifically designed for military members, reflecting their unique needs and circumstances. For instance, they provide discounts for:

- Active Duty: Active duty military personnel receive a discount on their premiums, recognizing their commitment to service.

- Veterans: Veterans who have served honorably are also eligible for discounts, acknowledging their contributions to national security.

- Reservists: USAA recognizes the commitment of reservists by offering discounts to those serving in the reserves.

- Military Spouse: Spouses of active duty military members often face unique challenges due to their partner’s deployment and relocation. USAA offers discounts to spouses to acknowledge these challenges.

- Military Family Members: USAA extends discounts to other eligible family members of military personnel, recognizing the importance of supporting the entire family.

USAA’s deep commitment to the military community is reflected in its carefully crafted discounts and benefits designed to meet the unique needs of service members and their families.

Military Base Vehicle Storage Discount

If you’re stationed on a military base, USAA offers a discount for storing your vehicle there. This can lead to substantial savings on your comprehensive insurance coverage, as the risk of theft or damage is often lower on a secure military installation. In some states, like California, this discount may also apply to your collision coverage, further enhancing your savings.

Military Deployment Discounts

USAA recognizes the unique challenges of military deployment and offers a 25% discount on your auto insurance premiums if you’re deployed to an imminent danger pay zone. This can provide much-needed relief during a time of increased stress and uncertainty, allowing service members to focus on their duties without the added worry of financial strain.

Other Military-Specific Discounts

In addition to the base storage and deployment discounts, USAA offers a range of other savings opportunities tailored to the military community. These include discounts for active duty, veterans, reservists, and even a loyalty discount for long-term USAA members. By taking advantage of these specialized offerings, you can maximize your savings and ensure your auto insurance coverage is as affordable as possible.

Get Your Auto Insurance USAA Quote

Obtaining a USAA auto insurance quote is a straightforward process that can be completed entirely online or through the company’s mobile app. To get started, simply visit the USAA website and click on the “Get an auto quote” button.

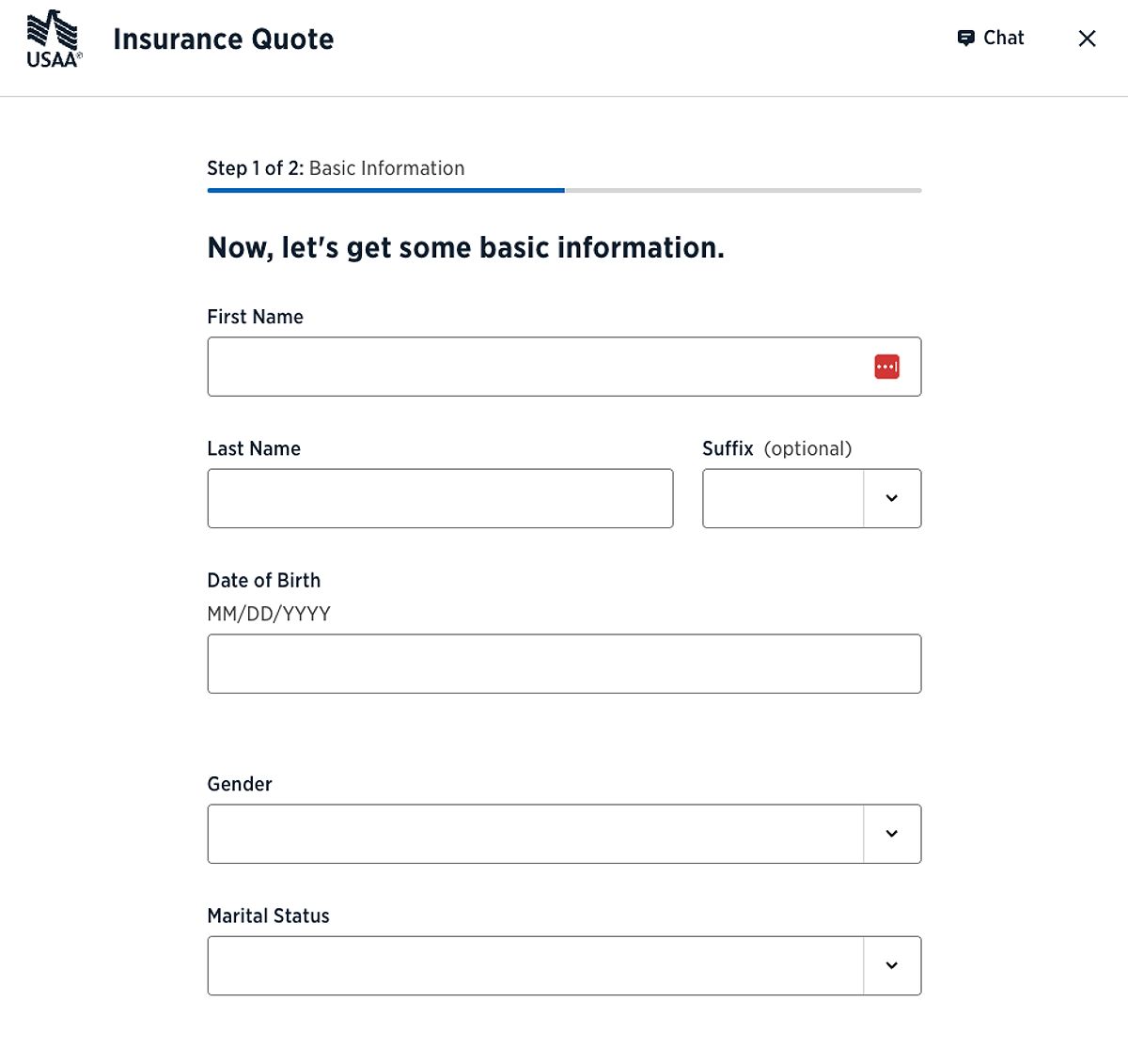

You’ll be prompted to provide some basic information, such as your ZIP code, name, date of birth, military status, vehicle details, and driving history. Be sure to have all the necessary documents on hand to ensure an accurate quote. Once you’ve entered the required information, USAA will generate a personalized quote tailored to your specific needs.

Online Quote Process

The online quote process is designed to be user-friendly. After clicking the “Get an auto quote” button, you’ll fill out a series of forms that ask for essential details. This includes information about any additional drivers, your previous insurance history, and your preferred coverage options. The more accurate the information you provide, the more precise your quote will be.

Mobile App Option

USAA also offers the convenience of obtaining a quote through their mobile app. This option is particularly useful for service members who are often on the move. Simply download the app, log in or create an account, and follow the prompts to receive your quote. The mobile app also allows you to manage your policy, file claims, and access customer service, making it a comprehensive tool for your insurance needs.

Personalized Quotes and Coverage Customization

During the quote process, you’ll have the opportunity to customize your coverage options. USAA allows you to adjust liability limits, choose deductibles, and add features such as roadside assistance or rental car reimbursement. This flexibility ensures that you can find the right balance of protection and affordability for your situation.

It’s essential to take the time to review each option carefully. Consider your driving habits, the value of your vehicle, and any specific needs you may have. This will help you make an informed decision that aligns with both your budget and your coverage requirements.

Comparing Quotes

While USAA is an excellent choice for many military members, it’s always a good idea to compare quotes from multiple insurers. This comparison can help you ensure you’re getting the best deal on your auto insurance. Take a few minutes to explore your options, and you can be confident that you’re making an informed decision about your auto insurance.

Comprehensive Coverage Options for Military Members

USAA provides a comprehensive suite of auto insurance coverage options, ensuring that military members and their families have the protection they need. From liability coverage to collision and comprehensive protection, USAA’s offerings cater to the unique needs of the military community.

Liability Coverage

As a service member, having adequate liability coverage is particularly important. USAA’s liability policies can help protect your finances in the event of an at-fault accident, covering costs for bodily injury and property damage to others. This coverage is especially crucial if you’re stationed overseas or frequently traveling for military duties.

Collision and Comprehensive Coverage

USAA’s collision and comprehensive coverage can provide valuable protection for your vehicle, whether you’re dealing with an accident or unexpected events like theft, vandalism, or natural disasters. This coverage can be especially beneficial for military members who may need to frequently relocate or store their vehicles on base.

Uninsured/Underinsured Motorist Coverage

In the unfortunate event of an accident with an uninsured or underinsured driver, USAA’s uninsured/underinsured motorist coverage can help cover the costs. This protection is particularly important for service members who may be stationed in areas with higher rates of uninsured drivers.

Additional Coverage Options

USAA also offers various additional coverage options to enhance your policy further. These include roadside assistance, rental car reimbursement, and personal injury protection. Each of these options can be tailored to fit your specific needs, ensuring you have comprehensive coverage that meets your lifestyle and circumstances.

USAA Auto Insurance Claims Process

Filing a claim with USAA is a relatively straightforward process, with several options available to make the experience as smooth as possible. You can start the claims process online, through the USAA mobile app, or by calling the dedicated customer service line.

Filing a Claim

When submitting a claim, be prepared to provide detailed information about the incident. This includes the date, location, and any relevant documentation such as police reports or repair estimates. USAA’s experienced team will guide you through the process and work diligently to resolve your claim promptly.

Claims Handling

USAA prioritizes a smooth and efficient claims process for military members, recognizing that they may face unique circumstances and time constraints. The company offers:

- 24/7 Claims Support: USAA provides 24/7 claims support, ensuring that military members can file a claim anytime, anywhere.

- Dedicated Military Claims Representatives: USAA has dedicated claims representatives who understand the specific needs and challenges faced by military members, providing personalized support throughout the claims process.

- Expedited Claims Processing: USAA prioritizes the processing of claims for military members, recognizing the urgency of their needs during deployment or relocation.

While USAA generally receives positive feedback for its claims handling, some customers have reported instances of delays in processing claims or communication issues. It’s important to note that individual experiences may vary, and it’s always advisable to read reviews and research customer feedback before making a decision.

Customer Feedback

Customer feedback regarding USAA’s claims process tends to be favorable. Many military members appreciate the understanding and support provided by USAA representatives, who are often well-versed in the unique challenges faced by service members. According to J.D. Power, USAA consistently ranks among the highest in customer satisfaction surveys for its claims handling process. This level of expertise can make a significant difference during a stressful time.

Frequently Asked Questions

Q: How do I know if I’m eligible for USAA auto insurance?

A: To be eligible for USAA auto insurance, you must be an active, retired, or honorably separated member of the military, or an eligible family member, such as a spouse or child of a USAA member. You can visit the USAA website to check the full eligibility criteria.

Q: What are some of the key benefits of USAA auto insurance?

A: The main benefits of USAA auto insurance include exclusive military discounts, a dedicated customer service team with expertise in serving the military community, and a strong financial standing with excellent ratings from industry organizations.

Q: How can I get started with a USAA auto insurance quote?

A: To get a USAA auto insurance quote, simply visit the USAA website or download their mobile app. You’ll be prompted to provide some basic information about yourself, your vehicle, and your driving history, and USAA will generate a personalized quote for you.

Q: How do USAA’s rates compare to other insurers?

A: USAA typically offers competitive rates compared to other insurers, particularly for military members. Their discounts and benefits tailored to the military community further enhance their affordability.

Conclusion: Unlock Unbeatable Savings with USAA Auto Insurance

USAA offers a comprehensive suite of auto insurance options designed specifically for military members. By taking advantage of their exclusive discounts, dedicated customer service, and competitive rates, you can ensure that your auto insurance needs are met while maximizing your savings. To get started, visit the USAA website or download their mobile app and request a personalized quote today.

In summary, if you are part of the military community, obtaining a USAA auto quote insurance is not just a choice; it’s a smart decision that reflects an understanding of your unique needs. Don’t hesitate to apply for USAA auto insurance and experience the peace of mind that comes with knowing your vehicle is protected by a provider that truly understands the unique challenges of military life.